CYNTA

CYNTA

6–12% Compounding Monthly Returns With CFA-Supervised, Fully Automated AI Trading

Your capital stays in your own U.S. brokerage account. Our AI executes trades automatically under strict CFA-led risk oversight, delivering disciplined, data-driven growth without you lifting a finger.

What You Get

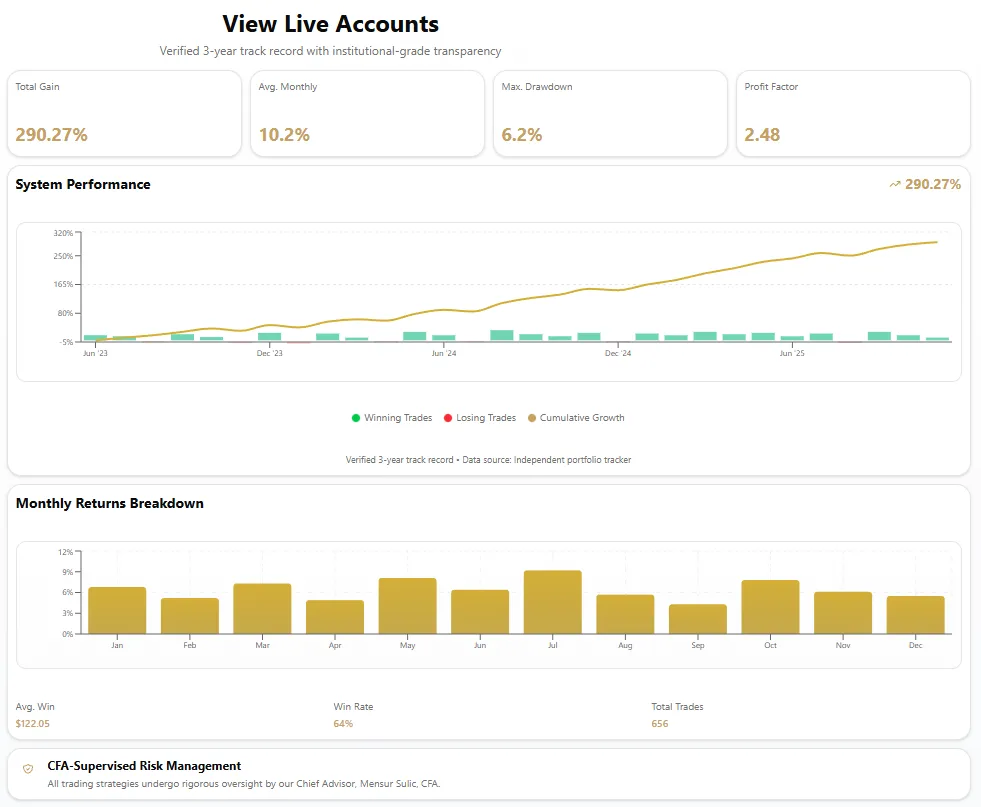

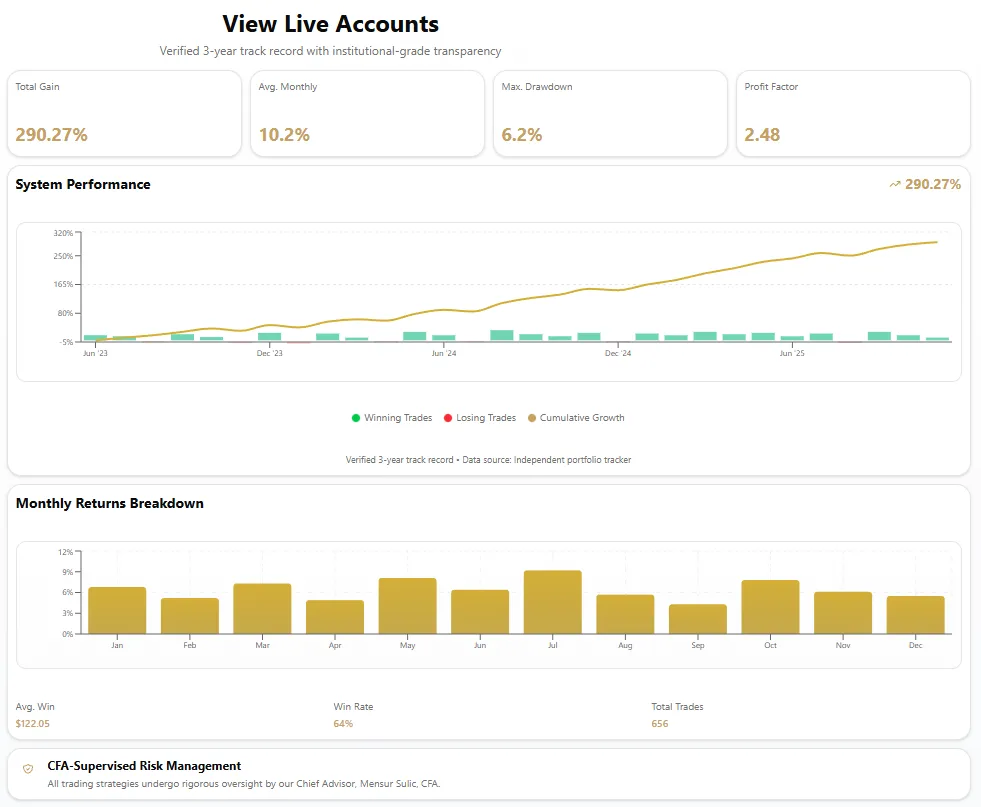

Proven 6-12% Monthly Returns

Proven 3 Year Track Record

Fully Automated Trading

100% AI-Powered, this is not an algorithm.

CFA-Supervised Risk Management

90-Day Money-Back Guarantee

12-Month Performance Guarantee

Other Algorithms

Usually Martingale or Grid.

Need drawdown to make money.

Cannot predict or plan for potential losses.

Expose large amounts of balance to constant risk.

Unlimited risk.

Cheap to build.

Unable to adapt to market conditions.

Cynta Trading

Does not need drawdown to make money.

Fully automated, no management.

Can accurately predict potential losses for clear risk assessments.

Fully Adaptive AI, with extensive data collection.

Limited risk, paired with capital preservation.

CFA-supervised risk management.

Doesn't need drawdown

Success Stories

★★★★★

"I started with Cynta in February. As of today, my account is up 76.4%, but what impressed me most wasn't just the returns. It's the consistency and the risk management. I've been in finance for 12 years and this is the first system I've used that behaves like an institutional desk."

— Dwight Caruso

6–12% Compounding Monthly Returns With

CFA-Supervised, Fully Automated AI Trading

Your capital stays in your own U.S. brokerage account. Our AI executes trades automatically under strict CFA-led risk

oversight, delivering disciplined, data-driven growth without you lifting a finger.

What You Get

Proven 6-12% Monthly Returns

Proven 3 Year Track Record

Fully Automated Trading

100% AI-Powered, this is not an algorithm.

CFA-Supervised Risk Management

90-Day Money-Back Guarantee

12-Month Performance Guarantee

Other Algorithms

Usually Martingale or Grid.

Need drawdown to make money.

Cannot predict or plan for potential losses.

Expose large amounts of balance to constant risk.

Unlimited risk.

Cheap to build.

Unable to adapt to market conditions.

Cynta Trading

Does not need drawdown to make money.

Fully automated, no management.

Can accurately predict potential losses for clear risk assessments.

Fully Adaptive AI, with extensive data collection.

Limited risk, paired with capital preservation.

CFA-supervised risk management.

Doesn't need drawdown

Success Stories

★★★★★

"I started with Cynta in February. As of today, my account is up 76.4%, but what impressed me most wasn't just the returns. It's the consistency and the risk management. I've been in finance for 12 years and this is the first system I've used that behaves like an institutional desk."

— Dwight Caruso

About Cynta AI

Cynta represents a paradigm shift in algorithmic trading, offering institutional-grade AI that adapts to market conditions in real-time. Developed over 15+ years of hands-on experience managing portfolios for ultra-high-net-worth individuals and institutions.

Our proprietary AI system employs advanced neural networks and ensemble learning techniques to identify high-probability trading opportunities across multiple asset classes.

CFA-Supervised Risk Management Framework

Under the direct supervision of our Chief Advisor, Mensur Sulic, CFA, every aspect of Cynta's risk management adheres to institutional standards used by hedge funds and asset managers.

Institutional Pedigree, Retail Accessibility

What was previously exclusive to institutions managing eight and nine-figure portfolios is now available to qualified investors.

Ready to Transform Your Trading?

Join hundreds of investors using Cynta's AI-driven trading system.

About Cynta AI

Cynta represents a paradigm shift in algorithmic trading, offering institutional-grade AI that adapts to market conditions in real-time. Developed over 15+ years of hands-on experience managing portfolios for ultra-high-net-worth individuals and institutions.

Our proprietary AI system employs advanced neural networks and ensemble learning techniques to identify high-probability trading opportunities across multiple asset classes.

CFA-Supervised Risk Management Framework

Under the direct supervision of our Chief Advisor, Mensur Sulic, CFA, every aspect of Cynta's risk management adheres to institutional standards used by hedge funds and asset managers.

Institutional Pedigree, Retail Accessibility

What was previously exclusive to institutions managing eight and nine-figure portfolios is now available to qualified investors.

Ready to Transform Your Trading?

Join hundreds of investors using Cynta's AI-driven trading system.

CYNTΑ

Past performance is not indicative of future results. Trading involves risk and may not be suitable for all investors.

CYNTΑ

Past performance is not indicative of future results. Trading involves risk and may not be suitable for all investors.

Calculate Your Potential Earnings

Cynta Profit Calculator

Initial Investment

$15,000

Estimated Profit

$27,190

Final Amount

$42,190

Potential Loss

$450